Insurance claim roofing can feel overwhelming when storm damage hits your Columbus home. The average homeowner receives $13,000 for wind and hail claims, while roof replacement costs average $9,150. Understanding the process before you need it can mean the difference between a smooth claim and thousands in out-of-pocket expenses.

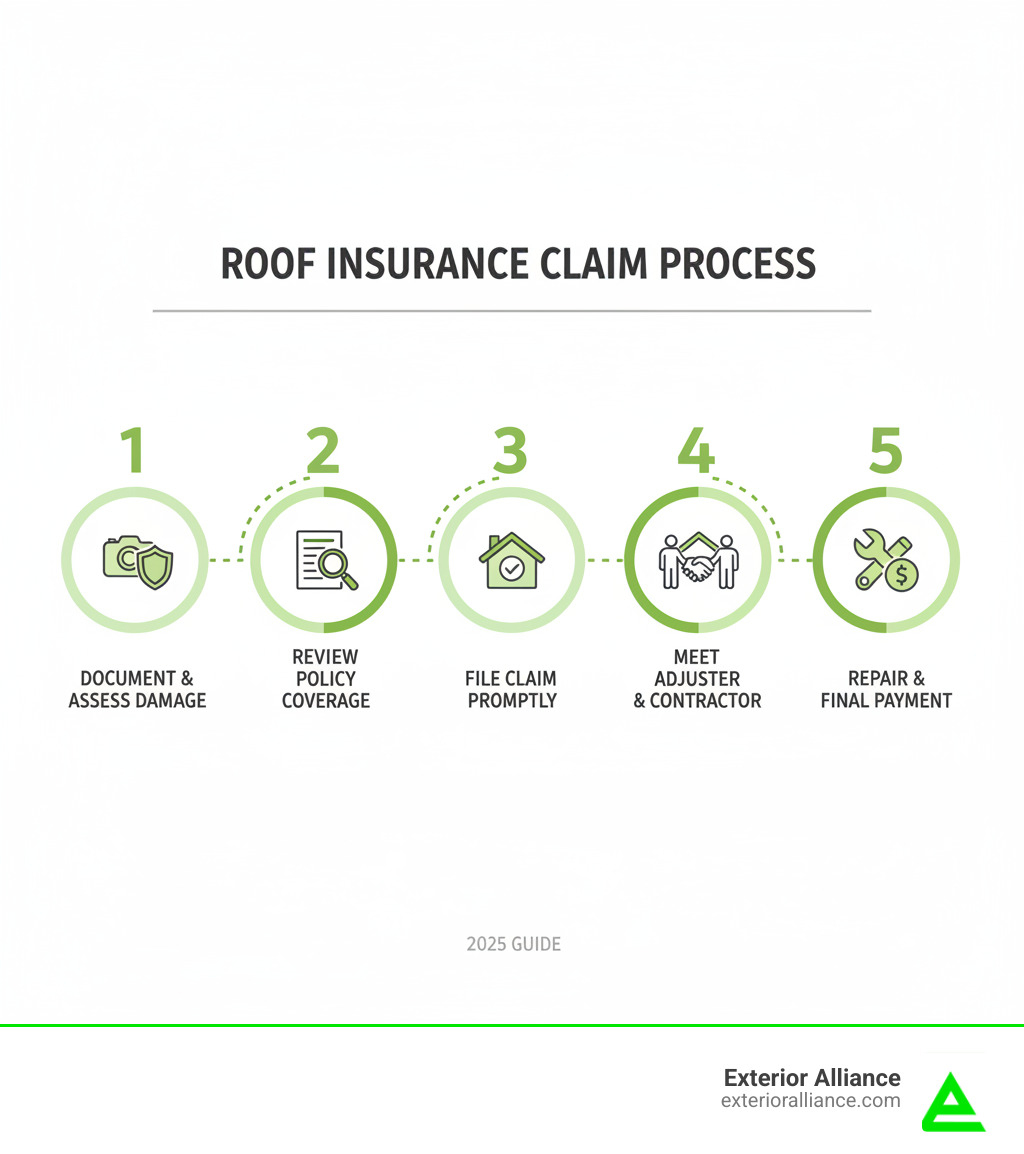

Quick Answer: Insurance Claim Roofing Process

- Assess Damage – Document storm damage with photos immediately

- Review Policy – Check coverage for sudden, accidental damage (wind, hail, fire)

- File Claim – Contact insurer within 30-60 days of damage

- Meet Adjuster – Have your contractor present during inspection

- Get Repairs – Choose your own licensed contractor for quality work

Most homeowner policies cover sudden damage from storms, wind, and hail under dwelling coverage. However, they don’t cover normal wear and tear, maintenance issues, or gradual deterioration.

The claims process typically takes 2-3 weeks for assessment and up to 45 days for final resolution. About 30% of roof damage claims face initial disputes, making it crucial to understand your rights and have proper documentation.

Whether you’re dealing with missing shingles after high winds or dents from hailstones, knowing what to expect can help you steer the process confidently and get your roof restored properly.

A Step-by-Step Guide to the Insurance Claim Roofing Process

When storm clouds roll through Ohio and leave your roof damaged, the aftermath can feel overwhelming. You’re dealing with potential water damage, safety concerns, and the daunting prospect of navigating insurance paperwork. With the right approach and a trusted partner like us at Exterior Alliance, the insurance claim roofing process becomes much more manageable. We’ve guided countless homeowners in Dublin, Columbus, and throughout Central Ohio through this exact situation. Homeowners who understand the process get better outcomes and less stress. Let’s walk through each step.

Step 1: Identifying Covered Damage & Understanding Your Policy

The foundation of a successful insurance claim roofing process is understanding your policy. Most homeowners insurance protects against “sudden and accidental” damage, which we see regularly in Ohio after severe weather.

What gets covered? Most policies protect against:

- Wind damage: Winds over 60 mph can lift shingles, tear off roofing sections, or loosen flashing.

- Hail damage: Ice balls create dents and cracks, compromising your shingles’ protective layer.

- Fallen trees or branches from storms.

- Fire damage from lightning strikes.

- Weight of snow or ice causing structural damage.

What’s not covered is just as important. Insurance doesn’t pay for normal wear and tear as your roof ages. Neglect or failure to perform maintenance is also excluded, as is poor workmanship from a previous contractor. Finally, flood damage requires a separate policy.

Before filing, review your policy for coverage limits, your deductible, and exclusions. Understanding if you have Actual Cash Value or Replacement Cost Value coverage is critical. If the language is confusing, we can help. For a deeper dive, watch the Understanding Your Insurance Policy video series.

Step 2: When to File a Claim vs. Pay Out-of-Pocket

A common question is, “Should I file a claim or pay myself?” It’s a strategic decision.

Filing makes sense for extensive damage where repair costs will far exceed your deductible. With an average roof replacement costing around $9,150 and deductibles from $500 to $2,000, filing for major damage is what you pay premiums for.

Paying out-of-pocket works better for minor issues, like a few loose shingles, where the cost is close to your deductible. A small payout might not be worth having a claim on your record, as multiple claims in a short period can lead to higher premiums.

However, don’t ignore minor damage. A small leak can quickly become a $15,000 headache. We recommend a professional inspection after any major storm to understand the true extent of damage and make an informed decision. For specific guidance, check out our hail damage roofing services.

Step 3: How to File Your Claim and Work With an Adjuster

Once you decide to file a roofing insurance claim, speed and documentation are key. Insurers typically require claims within 30-60 days.

Start by documenting everything. Take clear photos and videos of all damage—both close-ups and wider shots for context, including interior water stains. You’ll need your roof’s age, the date of the storm, and any maintenance records.

Make necessary temporary repairs, like tarping a leak. This is expected, and the costs are usually reimbursable, so keep all receipts. Avoid major permanent repairs until your claim is approved.

When working with the insurance adjuster, have your contractor present. The adjuster’s job is to verify the claim and determine coverage. They often use software like Xactimate to calculate costs, but it may not account for local codes or conditions. Having one of our team members present ensures nothing gets overlooked.

Step 4: The Role of a Roofing Contractor in Your Insurance Claim Roofing Process

Think of your roofing contractor as your advocate in the insurance claim roofing process. Homeowners who partner with experienced contractors get better, faster outcomes.

Our role begins with a free professional inspection to identify damage and determine if it’s likely covered. During the adjuster’s visit, our presence is crucial. We speak the same technical language and can point out subtle damage like hail dents that might be missed, which can result in thousands of dollars in additional coverage.

We also review and supplement the estimate. Insurance estimates often miss items like local building code requirements or dump fees. We submit supplemental claims to ensure you receive fair compensation.

You have the right to choose your own contractor. Be wary of anyone offering to pay your deductible (insurance fraud) or pressuring you to sign contracts before claim approval. For more on wind damage, visit our wind damage roofing services page.

Step 5: Understanding Your Settlement: ACV vs. RCV

The difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) can mean thousands of dollars out of your pocket.

Actual Cash Value (ACV) policies pay the depreciated value of your roof. If a new roof costs $15,000 but your 10-year-old roof has depreciated by $10,000, an ACV policy might only pay $5,000 (minus your deductible).

Replacement Cost Value (RCV) policies cover the full cost to replace your roof with new materials, without depreciation. These policies typically pay in two stages: an initial ACV payment, and the remaining “recoverable depreciation” after repairs are completed.

| Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|

| Payout: Depreciated value only | Payout: Full replacement cost |

| Your cost: Deductible + depreciation amount | Your cost: Primarily just deductible |

| Coverage: Less comprehensive | Coverage: More comprehensive |

| Premiums: Generally lower | Premiums: Generally higher |

RCV policies are almost always better for homeowners, as the slightly higher premiums are worth the superior coverage when you need it.

Step 6: What to Do If Your Insurance Claim Roofing is Denied

A claim denial isn’t always the end of the story. About 30% of roof damage claims face initial disputes.

Common reasons for denial include damage attributed to wear and tear, insufficient documentation, or policy exclusions. If your claim is denied, first understand the written explanation from your insurer. Next, get a second professional opinion. A more thorough inspection can provide the evidence needed to overturn a denial.

You can then begin the appeals process; statistics show about 40% of appealed claims result in increased settlements. Most insurers have a 30-day window to appeal, so act quickly. As another option, public adjusters work for you to re-evaluate damage and negotiate with the insurer.

To avoid these pitfalls, file promptly, document everything, and work with experienced storm restoration specialists like us. For comprehensive information about storm damage restoration, visit our storm damage services page.

Get Your Roof Repaired Right with an Experienced Partner

When storm clouds clear, the insurance claim roofing process can feel overwhelming, but you don’t have to steer it alone. By understanding your policy, documenting damage thoroughly, and partnering with an experienced professional, you set yourself up for a smooth process and a successful outcome.

Your contractor should be your strongest advocate. At Exterior Alliance, our team understands industry software, knows local building codes, and speaks the same language as adjusters. We attend the inspection to ensure nothing is missed and that your final settlement is fair.

Quality repairs restore more than just your roof—they restore your peace of mind. Our BBB A+ rated team has helped homeowners in Dublin, Columbus, Powell, Hilliard, Lewis Center, Westerville, Upper Arlington, Groveport, Plain City, Huber Ridge, Grandview Heights, Pickerington, Bexley, New Albany, Delaware, and surrounding communities steer the insurance process with confidence. We specialize in insurance storm restoration because we understand the challenges Ohio weather brings.

When the next storm hits, you’ll be prepared. Ready to learn more about protecting your most important investment? See why so many Ohio homeowners trust us with their insurance claim roofing needs: More info about residential roofing services.